A higher score (700 or better) makes it easier for you to get approval for loans and credit cards. Read on to learn more about why credit matter.

If you’re just starting out, you may not have a credit history because you don’t have any credit cards, loans or bills in your name. Or it’s possible you have a very low credit score, and part of the reason why is you don’t know much about credit.

Everyone has to start somewhere, so here’s what you need to know about credit.

The basics

As an adult, your credit score is one of the most important numbers in your life. It will help determine your eligibility to make major purchases like a home or a car, as well as qualify for smaller things, like a credit card with a low interest rate, a rental apartment or car lease, good rates on insurance premiums and more.

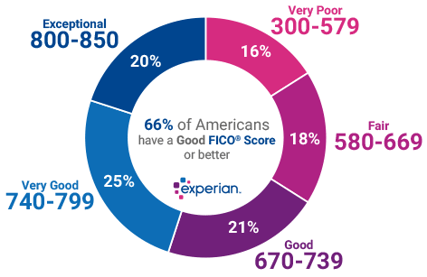

Experian, Equifax and TransUnion are the top three credit reporting agencies that keep track of all of your payment information, collecting it all together on your credit report. The data on your credit report is then used to calculate your credit score, which helps lenders and creditors determine your creditworthiness. These three-digit numbers, ranging from 300 to 850 go up and down, depending on how you perform in certain categories. A higher score (700 or better) makes it easier for you to get approval for loans and credit cards.

Image Source: Experian

How you can start building credit

The bottom line about building up to a good credit score is that it takes credit to get credit. You may need to get a cosigner - someone with a credit history in good standing that can vouch for you when you apply for a credit card or rental apartment.

Once you have these things in place, you’re ready to start building up your credit history to build up your credit score. The following are a few tips to help you build your credit score:

- Get in the habit of paying all your bills on time, including your rent and utilities.

- Get one or two credit cards, and use them for regular expenses. Be sure to pay them off every month.

- Get credit for paying your rent by using a rent-reporting service like CreditPop. That way you get credit for something you’d be doing anyways without taking on any debt.

- Keep an eye on your credit utilization. The trick is to use far less than what you have available to you to show you’re financially responsible.

- Review a copy of your credit report on a regular basis to be sure you’re on the right track (and ensure there are no errors on your report). You can get a free copy once annually from each of the three bureaus by visiting AnnualCreditReport.com.

The #1 thing you need to know about credit is that it matters - a lot. Those little three digits are the key to financial doors of opportunity for you, so take care to do all you can to make the right choices to build up your credit.

LevelCredit

LevelCredit