Short answer: no, but they definitely should.

Paying your rent on time is one of the most responsible habits a renter can have. However, this positive behaviour – that should serve as proof of your financial responsibility and credit worthiness – is overlooked by lenders and credit bureaus.

Why? Simply because no one really reports rent payments to the people who have the power to extend credit. The fact of the matter is, less than 1% of Americans see rental their payment history included in their credit report.

LevelCredit is righting this wrong.

How do I get credit by reporting rent and utility payments?

LevelCredit is a rent-reporting service that lets you report your rent and utility payments to credit bureaus, helping you build your credit score without accruing any further debt.

According to Abodo and Zillow, the typical American renter pays about $1,225 per month in rent and utilities. Reporting these one-time payments could (and should) go a long way toward helping you build credit. They’re your biggest financial outlay, and you’re delivering them on time, every month. That should win you approval from lenders.

When your rent is reported to major credit bureaus, it shows up on your credit report as a new tradeline with positive information. A tradeline is basically an “open account” on your credit report. That additional tradeline on your report can affect your credit score with more positive data, which can be used to calculate your score. The impact is largest for those with no credit or a low score, especially if it’s due to a thin credit record (that is, if the bureaus don’t have enough data on file for you).

Can this really increase my credit score?

Yes! The evidence is crystal clear. In 2018, we conducted a study looking at more than 36,000 of LevelCredit users who had been reporting their rent paymets to major credit reporting agencies for at least two years.

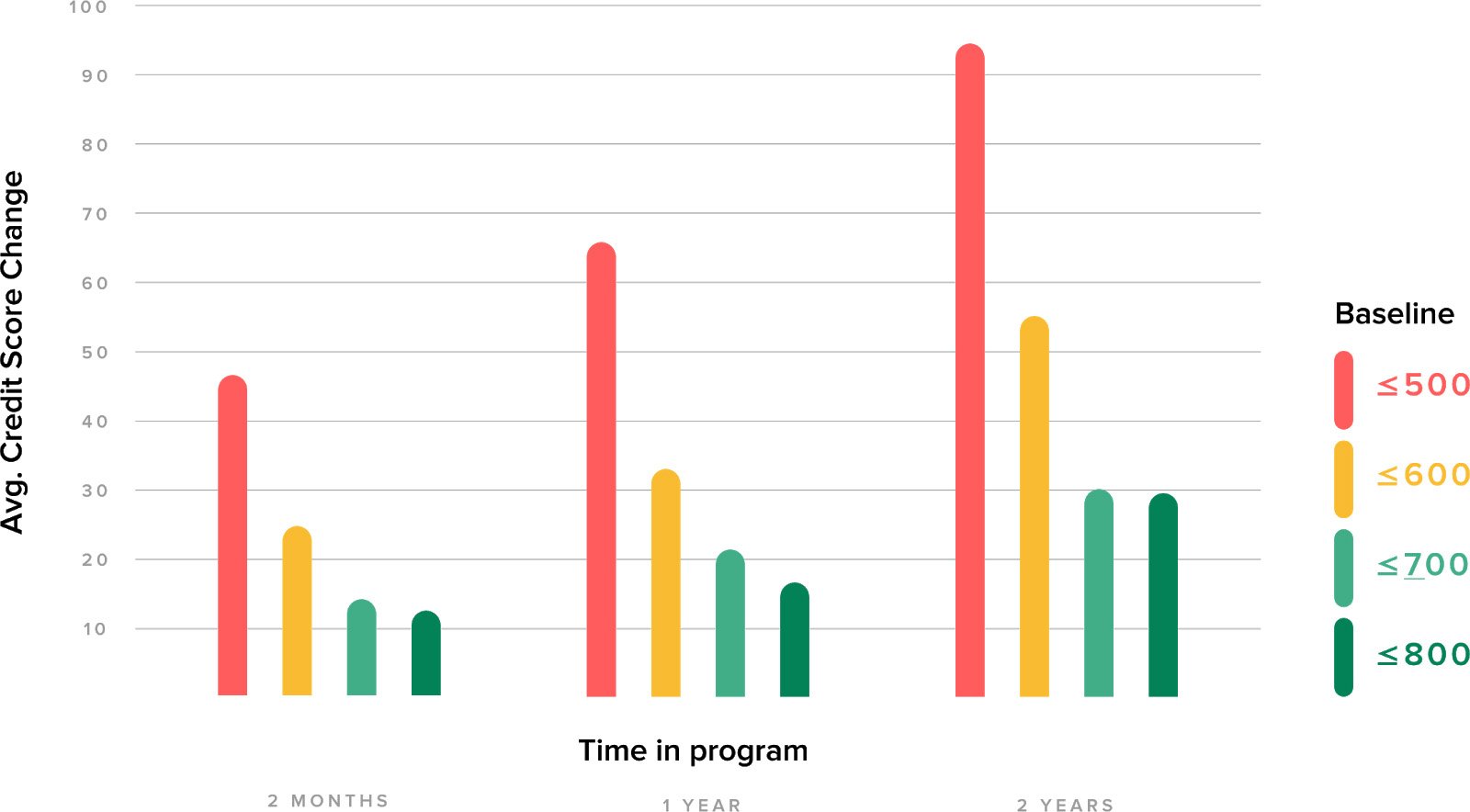

LevelCredit analyzed four credit score brackets to see how much reporting rent impacted scores after reporting it for two months, one year, and two years.

The results were astounding. On average, the data showed that Vantage3 scores increased by an average of 20 points in two months, and 50 points after two years.

The lower credit score bands saw the greatest score increases. Consumers who started with scores below 600 saw an average increase of 28 points within two months and 70 points after two years.

Proving your financial responsibility to lenders and credit bureaus is a surefire way to get your credit score to rise. With LevelCredit, now your rent and utilities can contribute to building your credit score. To find out more about how LevelCredit does this, click here.

LevelCredit

LevelCredit