Less than 1% of Americans see rental payment history in their credit report. Learn how reporting rent payments affects your credit score, and learn about the credit reporting and scoring industry.

The credit reporting and scoring industry is at an inflection point as more and more people find themselves either lacking credit altogether or not getting credit for their largest monthly expenses. Rent is one of the most telling examples. For more than 25% of Americans, rent is their largest monthly expense, and for people under 35 years old, over 60% are renters. However, less than 1% of Americans see their positive rental payment history in their credit files.

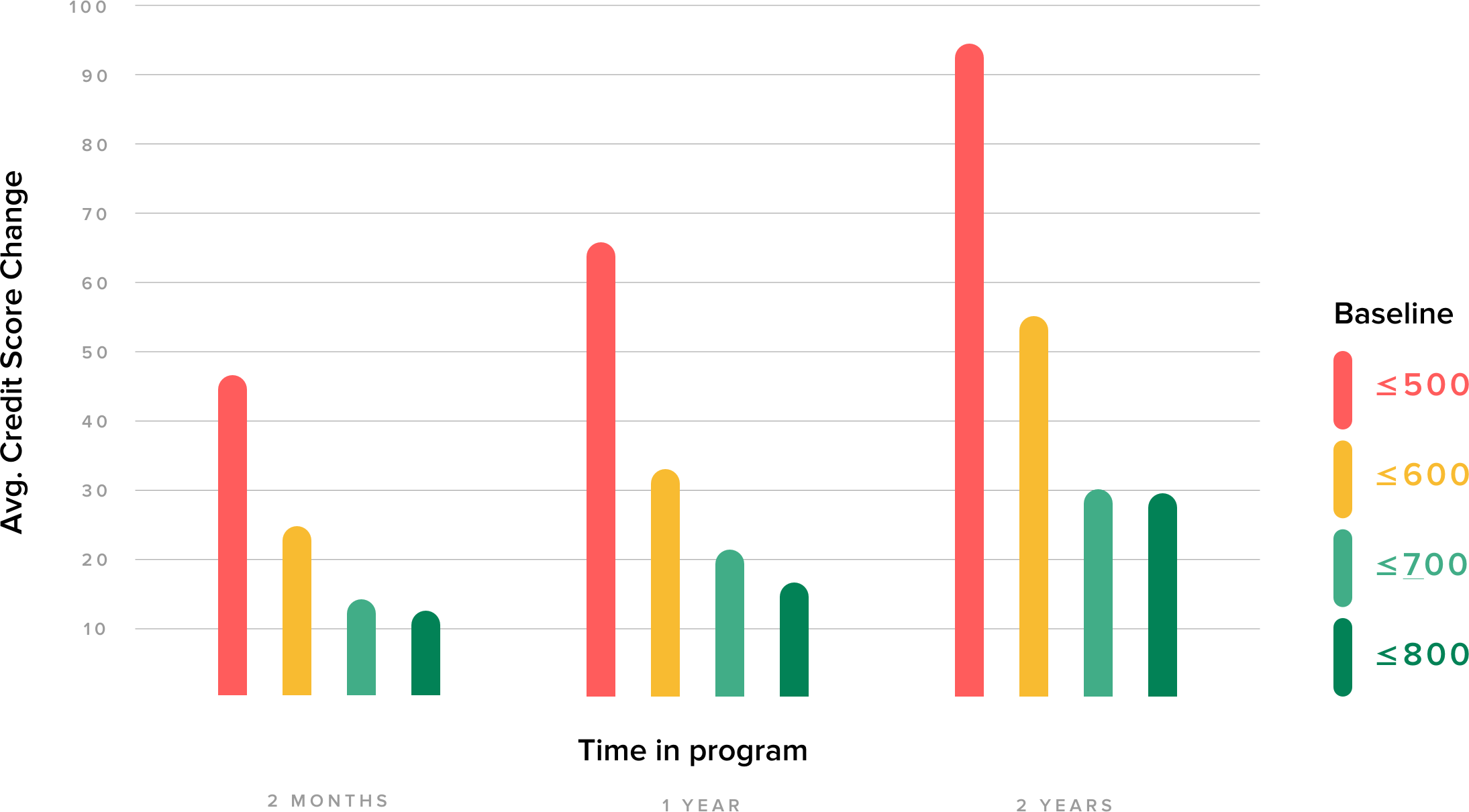

LevelCredit ran a study to see how much reporting this data affects credit scores.

The impact of reporting rent payments:

LevelCredit has been reporting rental payment history on behalf of renters for years, and those renters have seen results. In 2018, the company conducted a study looking at more than 36,000 of its users who had been reporting rent payments to the major credit reporting agencies for at least two years. LevelCredit analyzed four credit score brackets to see how much reporting rent impacted scores after reporting it for two months, one year and two years.

On average, the data showed scores increased by an average of 20 points in two months, and 50 points after two years. The lower credit score bands saw the greatest score increases. Consumers who started with scores below 600 saw an average increase of 28 points within two months and 70 points after two years.

Get the credit you deserve

The takeaway is clear: assuming that you pay your rent on time, reporting it can be a huge factor in your credit score, and in turn, what financial help you can get and interest rates you pay on everything from auto loans to mortgages.

While the credit bureaus accept rent payments today, your rent payments won’t be reported automatically. LevelCredit connects your rental payments to your credit file, and many of the major credit scoring models today factor rent and utilities into their algorithms. Learn how to get started here.

LevelCredit

LevelCredit