Your credit score tells a story about your track record of responsible credit habits. Find out what counts as a good score.

Your credit score is a number between 300 and 850 calculated from information that’s on your credit report, including things like your payment history, how much debt you have and how long you’ve actually had a credit history.

In the case of a credit score, it’s all about giving potential lenders and creditors (i.e. banks, credit card companies, credit unions, etc.) landlords and even employers insight into your behavior when it comes to managing your finances. This is an important way for them to determine your creditworthiness.

But what is a good score, and how is it different from an “average” score? Just where does it fall in the credit score range?

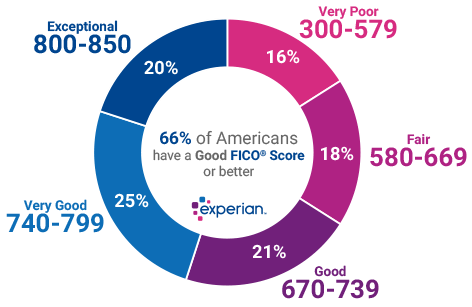

This graphic from Experian tells a clear story about the typical credit score range, from the lowest credit score possible to the highest one.

In general, a good credit score is between 670 and 739. This tells potential lenders and others that you’re a relatively safe bet. And while it doesn’t guarantee that you’ll get approved for credit or a super low interest rate, having a good credit score certainly opens financial doors.

According to recent information from FICO, the average credit score in the US. is 704, approximately in the middle of the “good” credit score range.

If you have a score of 740 up to 799, you’re considered in the “very good,” range, and 800-850 is “exceptional.” Those with the highest possible credit scores enjoy benefits that go beyond bragging rights: you may enjoy lower interest rates, higher credit limits, and more perks from lenders and credit card companies. Being responsible has its rewards.

Conversely, a fair score of 580-669 will categorize you as a “subprime borrower,” which means that you will likely have to pay higher interest rates on any credit you are approved for.

Those with a very low score of 300-570 will have a hard time getting credit or loans at all.

Sometimes you can’t avoid low scores, particularly if you’re just starting out or have had problems in the past like medical debt or unemployment, which can lead to accounts in collections. In those cases, there are definitely steps you can take to build your credit back up again, including making sure you get credit for paying your rent.

LevelCredit

LevelCredit